July 12, 2022

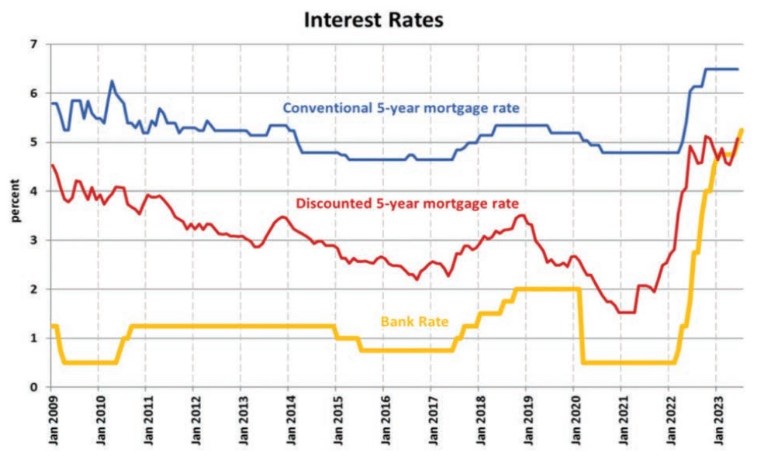

The Bank of Canada has increased its key policy interest rate to 5.00%—a jump of 25 basis points from June and the latest of 10 rate hikes in the last 16 months.

If real estate is about location, location, location, the central bank’s rationale is about inflation, inflation, inflation.

“While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from easing underlying inflation,” the Bank of Canada said in a statement.

“With three-month rates of core inflation running around 3½-4% since last September, underlying price pressures appear to be more persistent than anticipated. This is reinforced by the Bank’s business surveys, which find businesses are still increasing their prices more frequently than normal.”

Inflation in Canada has fallen from a peak of 8.1% last summer to 3.4% in May.

The Bank of Canada expects inflation to remain at about 3% for the next year before declining gradually to its 2% target by the middle of 2025, six months later than expected.

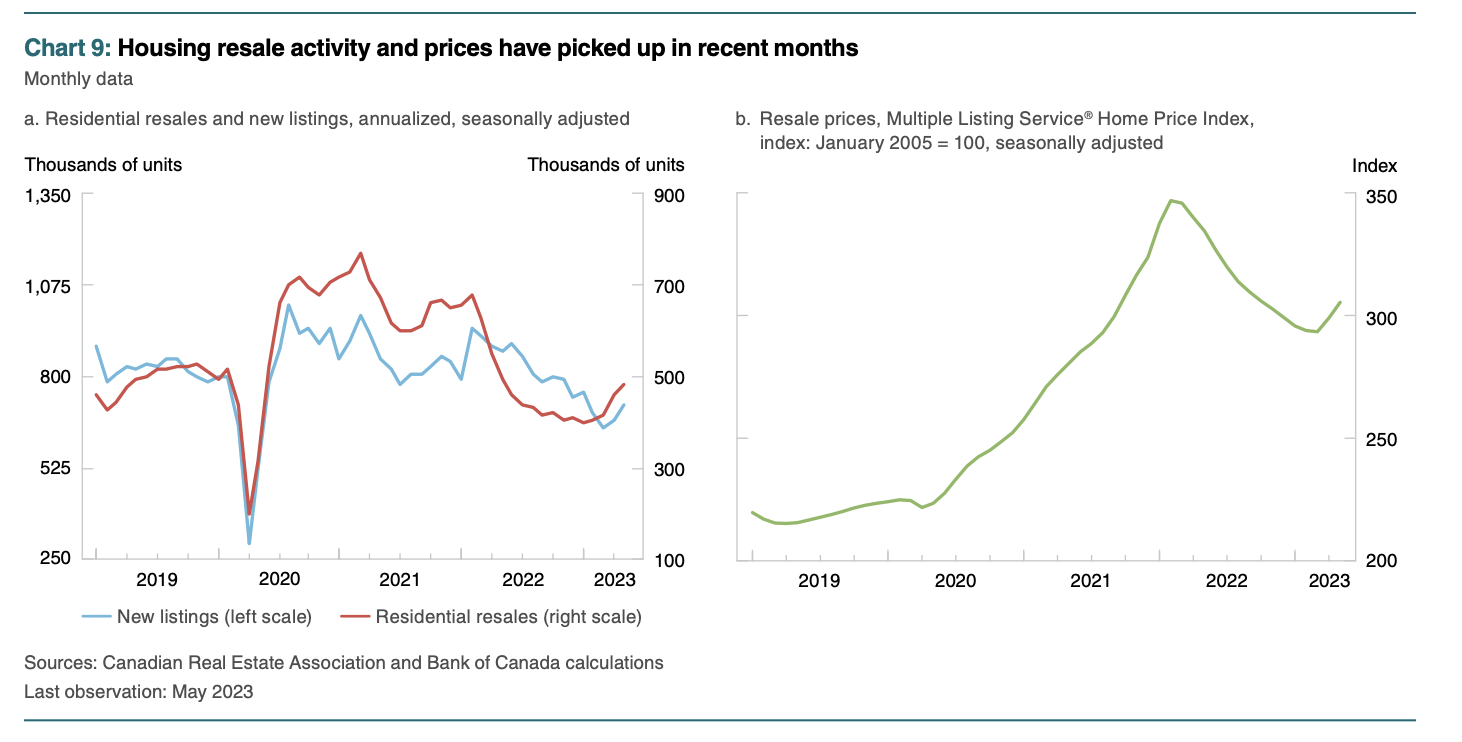

Housing prices received some of the closest attention from the Bank as it explained its decision.

Housing prices and inflation

“The previously unforeseen strength in house prices is likely to persist and boost inflation by as much as 0.3 percentage points by the end of 2023, compared with the January outlook,” the Bank said its newly published Monetary Policy Report.

The upward revision to the inflation outlook is due in part to those higher-than-expected house prices, the Bank said. House prices increased in May for the second straight month. Increases in both prices and resales have been widespread across the country and stronger than predicted in January.

Courtesy of Bank of Canada.

Time to reconsider short-term rate approach

Shaun Westlake, Vice-President, Sales, for Guiding Star Mortgage Group joined the chorus of experts not expecting rates to come down anytime soon.

The Bank of Canada’s extended timeline to 2025 for inflation reaching its target of 2% caught his attention.

“This is a slight change to earlier commentary and expectations which leads me to think we are going to see rates well above 5% for a much longer period than we had previously expected,” he said. “Many were previously banking on rates starting to come down in early 2024. I no longer see that happening.”

Guiding Star Mortgage Group’s Shaun Westlake suggests reconsidering short-term mortgage rate strategy.

Consumption levels and demand for housing will continue to rise and a growing population will mean more supply but also more demand for goods, all of which contributes to pressure on inflation rates, Westlake said.

“I expect that the interest rates we see today are going to be here for quite some time to come, so anyone who has been thinking short-term rates are the way to go should perhaps reconsider that approach,” he said.

A wallet wallop is around the corner for some Canadians, he said.

“We are getting into prime summer vacation time, people are still travelling, and spending,” Westlake said. “With inflation continuing to run above 3%, with interest rates not coming down any time soon, housing continuing to be in high demand, I do expect that this latest rate increase will start to really impact Canadians’ wallets.”

What impact does this have on home owners and home buyers?

The immediate impacts for home buyers are increased borrowing costs, which determines how much home a first-time home buyer can afford. With increasing home sales and lower-than-normal supply, buyers had been feeling the pressure once again during the spring market.

Source: Bank of Canada. RATESDOTCA.

The good news? Supply is opening up. According to CREA’s national statistics released on June 15th, the number of newly listed properties rose 6.8% month-over-month.

Current homeowners with a variable mortgage will also see another increase to their mortgage payments, and those looking to renew their mortgage may be in for quite a shock if they were able to lock in rates around the 2% levels seen just a few years ago.

Source:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link